Single Gummy Bear Earrings / Gummy Bears / Cute Earrings / Etsy

Amazon.ca: Gummy Bear Jewelry Kindle Books 1-48 of over 2000 results for gummy bear jewelry Results Price and other details may vary based on product size and colour. Pretty Smart …

Amazon.ca: Gummy Bear Jewelry Kindle Books 1-48 of over 2000 results for gummy bear jewelry Results Price and other details may vary based on product size and colour. Pretty Smart …

WHAT IS MOCHA HAIR? Okay so what hair color is mocha? We know it's a brown shade but there's a bit more to it. Mocha hair involves a rich medium-to-deep …

188 Free images of Mickey. Find an image of mickey to use in your next project. Free mickey photos for download. Find images of Mickey Royalty-free No attribution required High …

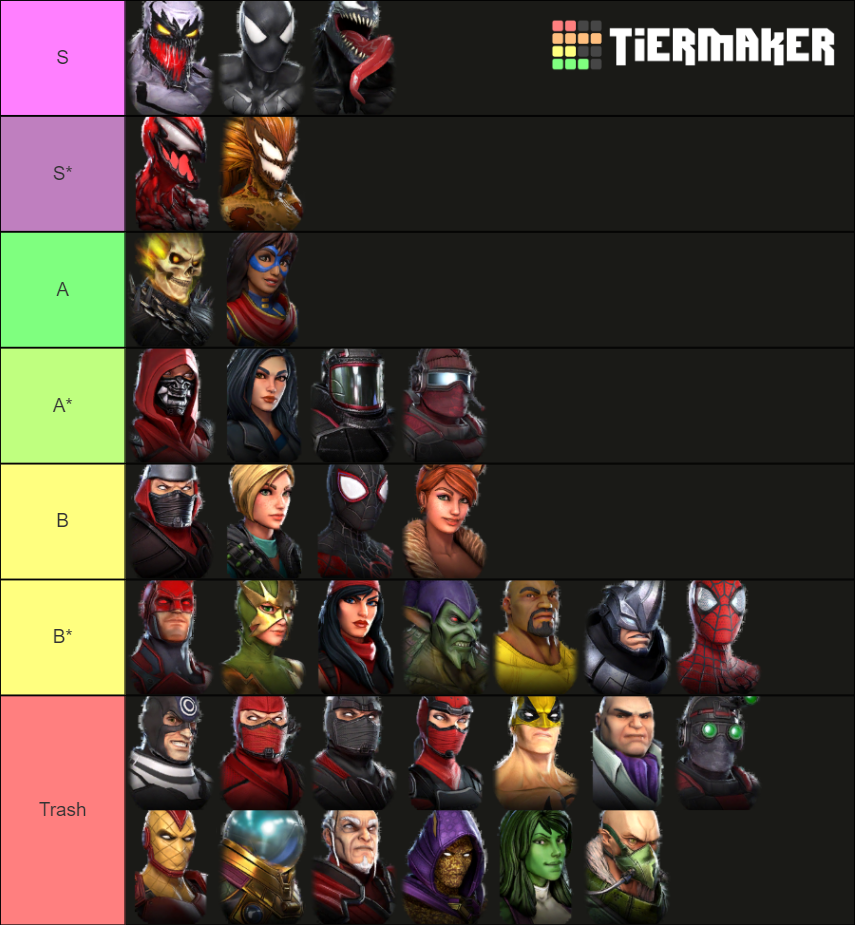

Marvel Strike Force Tier List (December 2023) Christian Grullon Jun 13 2023 Guides Marvel Strike Force Tier List for the Month of March Marvel Strike Force Screenshot via FoxNext/Scopely Ultimius …

Blue bird tattoos can also be designed in a variety of styles from traditional to modern making them a versatile option for anyone looking to express themselves through body art. …

26. Bubble Ponytail. The ponytail is one of the most versatile hairstyles you can try and it can be worn in several ways. You can channel the 80s with the …

The dream of having a nosebleed when someone hits you becomes a dream that shows that the more vigorous the red blood spouts the better your fortune and health. Hematemesis …

National Transport Tokens were used in lieu of or in combination with regular currency when paying for public transport in the United Kingdom . The tokens were usually purchased by …

Prep 20 mins with leftovers Ingredients 2 tsp ground cumin 2 tsp ground coriander 1 tsp smoked paprika 1 tsp ground ginger 1/2 tsp ground cinnamon 1/4 tsp ground turmeric …